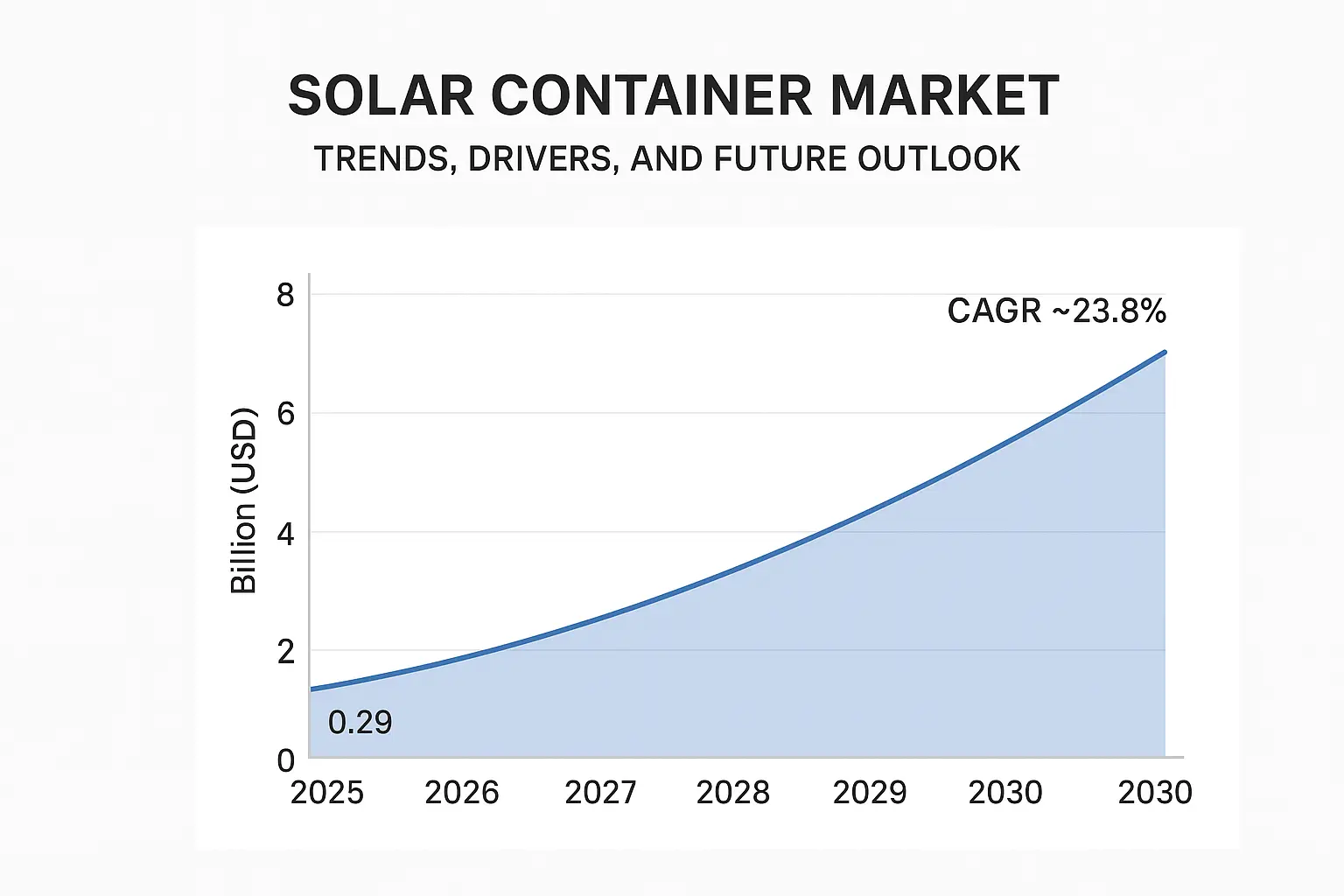

The solar container market is expected to grow rapidly in the coming years. According to MarketsandMarkets, the market size will rise from about $0.29 billion in 2025 to around $0.83 billion by 2030(a CAGR of ~23.8%). This surge is driven by a growing need for portable off-grid power in remote and disaster-affected areas, as well as supportive government incentives for renewable energy. Solar containers are shipping containers outfitted with solar panels, batteries, inverters, and management systems that provide flexible, emission-free power to a host of different applications, including emergency relief, rural electrification, military camps, and construction projects. However, these systems face high upfront costs and energy storage limitations that restrain adoption in cost-sensitive markets.

Key Growth Drivers

- Off-grid power demand: the fast-growing need for decentralized, movable renewable energy sources. Solar containers can be applied in cases when grid power is unavailable or unreliable; remote communities, disaster areas, mining/military spots.

- Government Support: Subsidies, tax incentives, and clean-energy mandates all help drive the demand for solar container projects worldwide. Programs for rural electrification and disaster resilience are especially fueling demand.

- Technology Advances: Advancement in solar panel efficiency, battery storage, and smart energy management through AI/IoT is making these systems more efficient and affordable. IoT monitoring and the design of hybrid systems are being integrated by manufacturers to achieve maximum performance.

- Electric Vehicles: Increasing adoption of EVs creates demand for off-grid charging stations. Analysts note that solar-powered remote charging stations using containers will enjoy one of the highest CAGRs due to rising rural use of EVs and disaster relief applications.

- Module Flexibility: The modular, portable nature of container systems-easy to ship and install-makes them ideal for temporary or emergency power needs, boosting adoption in construction, events, and field operations.

Market Constraints and Challenges

- High Initial Cost: The solar container setups employ very costly components, such as high-efficiency panels, advanced batteries, inverters, and controls. High upfront capital is one of the major barriers being pointed out, especially for smaller enterprises and rural communities.

- Variable Supply and Storage: Most of the solar generators are dependent on sunlight; therefore, power is intermittent at night and cloudy days. This makes batteries highly essential; however, batteries themselves have limited capacity and are very expensive and experience degradation over time. Energy shortfalls are experienced during bad weather or night.

- Awareness and Infrastructure: In the case of developing regions, poor awareness and weak infrastructure make adoption slow. Integrating containers with local grids or getting approval from regulatory bodies also remains a challenge.

- Durability and Maintenance: Containers deployed in harsh or remote environments must be weather- and heat- and dust-resistant. Adding durability and the ability for maintenance when necessary increases complexity.

Opportunities and Emerging Trends

- Smart Energy Management: Integration of containers with smart grids, AI-driven energy management, and IoT offers large efficiency gains. For instance, AI algorithms can predict power demand and weather to optimize battery use. Companies see this as a big opportunity to improve reliability and user control.

- Hybrid Systems: Solar containers are increasingly combined with other renewables such as wind and diesel backup for hybrid microgrids. Such systems ensure uninterrupted power. The combination of solar + storage + backup is a fast-growing trend in communities and industry.

- New Applications: The fastest-growing applications are solar irrigation for agriculture, which reduces fuel costs and increases yields, and also telecommunications-off-grid tower power. The Agriculture/Irrigation Segment: Because of the adoption of solar irrigation pumps, this segment will see the fastest growth.

- Electric Mobility: This was highlighted as an opportunity for the EV sector. In rural or emergency settings, solar container “charging pods” can support electric vehicles and equipment.

- Microgrid Expansion: Off-grid microgrid projects-for example, island or rural electrification initiatives-are often deploying containerized solar as building blocks. The push for energy access remains a highly untapped market.

Market Segmentation

Solar container products and projects are segmented into various categories:

- Type: Portable or fixed. The portable segment currently holds the largest share owing to its easy deployment for temporary requirements.

- Components: Systems include, among others, PV panels, batteries, inverters, monitoring/EMS. Each component drives part of the value chain. For example, battery storage covers a separate submarket-lithium-ion, lead-acid, sodium-ion.

- Power Capacity: Low (<10 kW), Medium (10–50 kW), High (>50 kW). Larger 50+ kW systems are in high demand for mining sites, large construction, and village electrification. These high-capacity units can power schools, clinics, or factories, so they capture significant market share.

- Type of Installation: On-grid (grid-connected) versus Off-grid. Off-grid containers serve remote sites, while on-grid units can feed excess solar power into the utility network.

- Application: Key end-uses include agriculture & irrigation-fastest growing due to solar pumps-remote charging stations, mining/military bases, energy companies, residential microgrids, and disaster relief. Each segment has unique needs for reliability and scale.

Regional Outlook

- Asia-Pacific: Expected to dominate the market during 2025–2030. Fast-track rural electrification, far-reaching solar potential, and effective government policies spur growth across the APAC region. Countries like China and India drive the growth of adoption, more so in the agricultural and remote industries.

- North America: Traditionally a leading market. In the US and Canada, interest comes from resilience-e.g., wildfire relief, remote telecommunication-plus incentives for clean energy. North America is continuing to push EV infrastructure development, which fuels demand for portable solar solutions.

- Europe: Very significant, owing to strict environmental targets. Active incentives are available in Germany and France. EU Green Deal and climate-neutral goals go well with solar container projects, for off-grid and industrial backup applications.

- Middle East & Africa: Emerging markets. Abundant sunlight, growing rural needs, and diversification initiatives boost this region. Similarly, countries like South Africa and the UAE are investing in solar containers to create energy security.

- Latin America: Opportunities abound in remote mining and rural areas. Governments of Brazil, among others, are piloting clean energy deployments. However, economic constraints and policy instability can limit growth in the short run.

Competitive Landscape

The major players in the global solar container market include manufacturers of specialized equipment and solar companies. For example,

- Yangzhou CIMC New Energy a, China-based major container producer, has decided to invest more in solar units.

- Ecosun Innovations operates from France and concentrates on modular off-grid solar solutions.

- BoxPower Inc. (USA) – Focuses on rapidly deployable solar microgrids.

- Faber Infrastructure (Germany) – Provides different types of containerized energy systems.

- Canadian Solar Inc., SunPower, Tesla (US) - Well-established solar companies that also enter the market with container products.

These and other companies pursue strategies such as new product launches, partnerships, and localized manufacturing. Competition is also driving standardization. For example, larger players are often the ones setting norms that others will follow. The market is fragmented but consolidating as big energy groups may buy specialized startups.

Use Cases and Examples

Solar containers are already in use around the world:

- Disaster Relief: Portable solar containers can be trucked in after hurricanes or earthquakes to power field hospitals, water purification, and communication equipment. Case studies emphasize "disaster relief and emergency response" applications.

- Rural Electrification: In areas without grid access, the containers provide village-level power. For instance, a modular solar container can power homes, clinics, and schools in one community simultaneously-a mini-grid.

- Military and Mining: Remote military bases and mining camps use them for reliable power. These users appreciate the units' portability and all-weather build. The containers can be moved when the needs of a site change.

- Agriculture: Solar irrigation containers installed by farmers run water pumps, which reduce costs for diesel fuel. The trend is expanding at an immense rate in sunny developing regions.

In actual practice, I have seen how NGOs combine solar containers with battery banks to run rural schools and clinics completely off-grid. The on-the-ground experiences underpin the impact of the technology on the communities.

Future Outlook and Trends

Looking ahead, the solar container market continues to exhibit strong growth. Various forecasts point towards high growth: 23–24% CAGR through 2030 and ~19% CAGR through 2035. Key factors shaping the future include:

- Cost Savings: Further reductions in PV and battery prices-as seen with the decrease of PV costs by ~90% within a decade-will make containers more affordable. We anticipate increased scale economies and falling energy storage costs will further quicken this adoption.

- Innovation:Improvements in battery density and panel efficiency are being developed. Integrated smart controls and remote monitoring will become standard, thus solving some of the problems described above.

- Policy Support: Tigher carbon targets will increasingly be coupled with incentives for off-grid solar. Climate resilience programs may fund large container deployments in flood/wildfire response.

- New Markets: Emerging applications may include containerized hydrogen production, portable solar-powered data centers, and hybrid "energy-as-a-service" models. Increasing partnerships between solar companies and telecom/utility providers could also lead to new business models.

In summary, the solar container market is maturing from niche to mainstream. Although high upfront cost remains a barrier, the benefits of flexibility, modularity, and sustainability are driving steady interest. In my view, with the proliferation of renewable projects across the world, solar container systems will become one of the common solutions for meeting remote and emergency energy needs.